Source: Thanh Nien News

Welcome to Vietnam, where the world is upside down! Anything you knew from other places needs to be forgotten here. Especially in insurance! They don’t really work here, or putting it another way, it is a weak and poorly effective system here. In this article we help you understand the context of the insurance industry and how The Extra Mile assists customers when insurances are needed.

Truth be told, in Vietnam almost everyone prefers to simply negotiate and pay each other based on estimated damage value or by paying back bills and writing an agreement. The majority of accidents are small, hence a quicker solution weighs more against a long and tedious process. BUT, you should still have at least the compulsory insurance, we will explain why.

Contents

1. Compulsory Liability Insurance

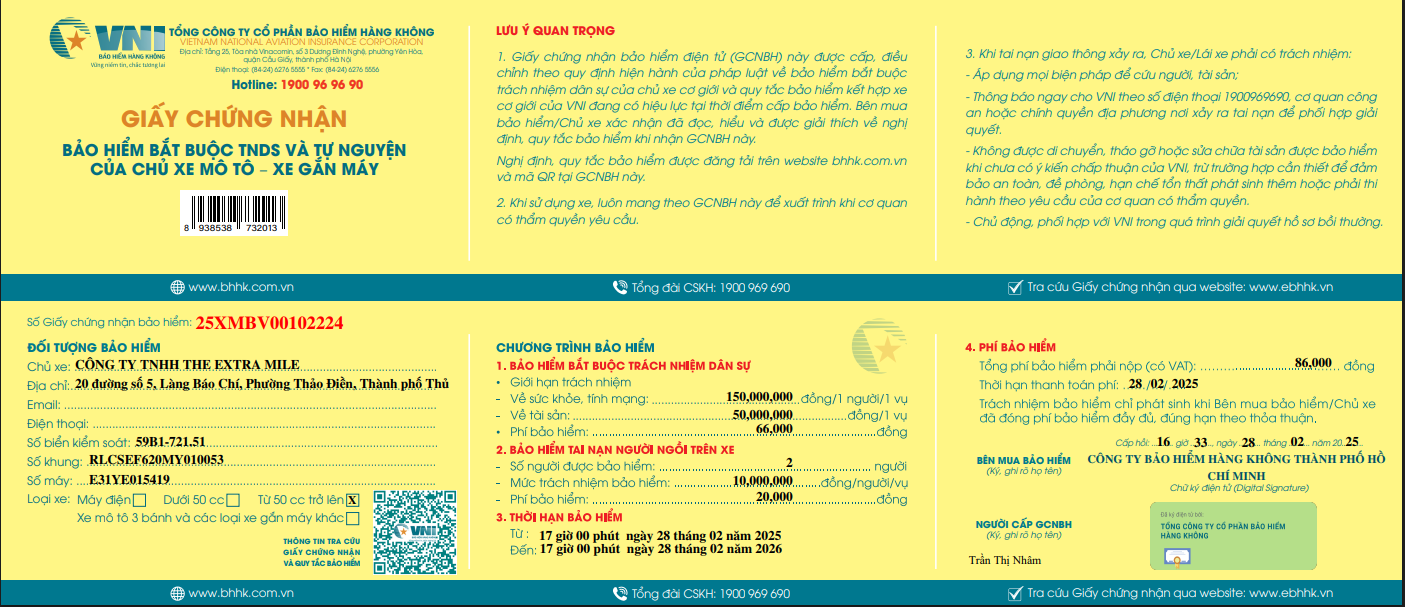

Under Vietnam’s Road Traffic Law and related regulations, carrying a valid “Certificate of Compulsory Civil Liability Insurance for Motor Vehicles” is one of the minimum legal requirements when riding. Without it, you are liable to fines from 100,000 to 200,000 VND, however we are yet to meet someone who was fined for this.

At The Extra Mile, all our rental bikes already come with compulsory liability insurance, so as long as you have a valid driver’s license, you are legally covered. This type of insurance has limited practical value. The compensation amounts are low (claimed at maximum 150,000,000 VND, though this amount is practically unheard of), and the claim process often drags on for months, which is why most riders don’t rely on it.

The compulsory insurance, which is a yellow paper printed or digital, is necessary in cases of accidents when the police is required to intervene and proceed with vehicle confiscation and an investigation. This happens when both parties fail to find an amicable arrangement, then the police must intervene and the compulsory insurance will be run by the government to decide who is responsible for what. This is why you should have it, it only costs 86,000 VND a year (official price) and not having it when needed can be an issue.

2. Voluntary / Comprehensive Insurance

Unlike compulsory insurance, some major companies such as Bảo Việt or Liberty Insurance offer more comprehensive policies with broader coverage. However, these policies are only available to the legal owner of the motorbike. In other words, they do not insure short-term rental bikes.

In rare cases, if a customer rents a bike long-term (12 months or more), The Extra Mile can help arrange such insurance through a notarized Power of Attorney that makes the rider a legal representative of the bike. The option is there though, if you rent a bike with a contract of at least 1 year, we can then introduce a trusted broker who knows our process.

That said, the process in Vietnam is still cumbersome, requiring multiple layers of paperwork, and when accidents happen, payouts can take months. We had one case of a customer hiring a professional insurance on a bike registered under The Extra Mile. When the time to claim came, the insurance company made it really complicated in terms of paperwork to process the claim. It may be worth it for important damage and for valuable bikes.

3. Damage Waiver

You won’t be able to get professional insurance for the bike’s damage, but you can get a damage waiver from us. Damage Waiver basically strips you out from the responsibility to cover damage resulting from an accident or fall. As long as you bring us the bike back even if in 2 pieces, we won’t charge for damage.

This is our solution for short-term rentals, to give a bit more peace of mind to the customer. Note that there are exclusions. The damage waiver only covers damage to the bike, but not to the accessories. Theft and loss of items is also not covered by the damage waiver.

Check all damage waiver details here.

4. Our Recommendation

If compulsory insurance is mainly about staying legally compliant, and voluntary insurance is impractical for short-term rentals, then personal insurance is what truly matters for travelers. This is the type of insurance that directly protects you (and not the vehicle.) Depending on the level (price) of the insurance, they may have packages that cover the third parties too.

The two most important categories are:

- Health insurance: covers hospital treatment, medical expenses, and medication if you are injured in an accident.

- Accident insurance: provides compensation for permanent injuries, loss of working ability, or more serious consequences.

Keep in mind that some insurance companies, both international and local, may ask for proof of legal residence and a valid driving license before they process your claim. Others are more flexible and will reimburse based on hospital records, bills, and accident reports.

Check Valid Driving Licenses in Vietnam here.

In the end, this is the insurance that matters, which you most likely won’t hire in Vietnam, or if you do, better hire a foreign EU regulated insurance company via a broker. For the bike, you can get damage waiver and not have to worry about those damages anymore. What you should worry about is yourself and your health. So, focus on a proper health/accident insurance for yourself and let damage waiver handle the bike.

NOTE! Hospitals will require a driving license if you come to them after a traffic accident, unless you were not the rider.

![[Driving Licenses] What is actually changing for Expats in Vietnam driving motorbikes From 01/01/2025?](https://theextramile.co/wp-content/uploads/2024/12/Driving-license-180x125.jpg)